Office | 647-794-7676

Toll Free | 1-877-354-0767

10 Years of GTA Prices: The Most Expensive Financial Decision Canadians Made Was Waiting

Oct 22, 2025

2 min read

0

15

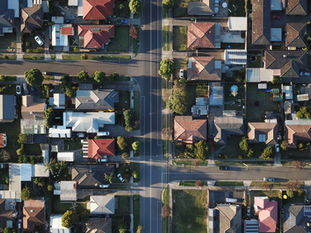

A lot of Canadians have spent the last decade “waiting for the right time” to buy a home.But when you look at what actually happened in the GTA, the truth is hard to ignore:

Not buying turned out to be far more expensive than buying.

At Swivel, we study long-term market patterns because most people only see what happened this year — not what compounded over ten.

What Actually Happened to GTA Prices

According to TRREB historical data, the average GTA home price in 2015 was roughly $640,000.In 2025, the average sits near $1.1 million.

Same region. Same streets. Same commute.About $460,000 higher — purely from time and demand.

That gain wasn’t earned through renovations or luck — it was earned by owning, not waiting.

Who Came Out Ahead — and Who Fell Behind

Those who bought:

Built hundreds of thousands in tax-free equity

Moved with the market instead of chasing it

Now have leverage to upgrade, refinance, or invest

Those who waited:

Now need almost double the mortgage qualification to buy the same home

Face higher down payments on a more expensive asset

Lost a decade to inflation and compounding gains

Here’s a comparison most people never calculate:

A typical homeowner earned more in equity than the average Ontarian earned in salary — without working extra hours.

Even a Starter Home Would Have Changed Everything

Maybe you couldn’t afford a detached home in 2015 — but even entry-level properties moved.

A $350K condo in 2015 now sells for $550K–$650K in many GTA submarkets.That’s $200K–$300K in growth on a starter property — just from entering the market.

You don’t need the perfect house.

You need a first door in.

Why This Matters Even More in Ontario

Ontario’s stress test, high current rates, and rapid population growth make it harder to “catch up” later.The longer you wait, the more the qualification gap widens.

Meanwhile, the province is only now beginning to accelerate supply through new housing laws — which may create windows of opportunity for buyers who are prepared, not spectators.

The Next 10 Years Will Create Two Groups Again

If the next decade looks anything like the last:

The biggest financial risk won’t be buying — it will be waiting again.

Real estate doesn’t reward perfection or timing —it rewards participation.

Swivel Perspective

At Swivel Mortgage Group, we don’t push people to buy homes they can’t afford —we help them build a plan to get into the market without getting stuck.

Because the past decade proved something important:

Doing nothing is also a decision — and it has been the most expensive one of all.