Office | 647-794-7676

Toll Free | 1-877-354-0767

New to Canada? Your Complete Guide to Buying Your First Home

Sep 26, 2025

3 min read

0

11

Moving to Canada is exciting — new opportunities, new communities, and for many newcomers, the dream of buying a home. But let’s be honest: the Canadian home-buying process can feel overwhelming. Between mortgages, down payments, taxes, and credit history, there’s a lot to navigate.

That’s why we’ve built this complete guide — to walk you through everything you need to know as a newcomer buying your very first home in Canada.

Step 1: Know Your Eligibility

As a permanent resident, landed immigrant, or valid work permit holder, you’re generally allowed to buy a home in Canada. However:

Immigration status matters. Lenders want to know you can stay and work in Canada.

International income may be accepted by some lenders if you provide the right documents.

Non-permanent residents sometimes face higher down payment requirements (often 35% or more).

Step 2: Build Your Canadian Credit

A strong Canadian credit score is one of the biggest factors in getting approved for a mortgage. Start building it as soon as you arrive:

Open a credit card and pay it off in full every month.

Pay rent, utilities, and phone bills on time.

Keep balances low compared to your credit limit.

💡 Some lenders accept international credit references — so don’t throw out your old records from back home!

Step 3: Save for Your Down Payment & Closing Costs

Here’s what you’ll need:

Down payment: Minimum 5% of the purchase price if the home is under $500,000. More is required above that threshold.

Closing costs: Budget at least 2–4% of the purchase price for things like land transfer tax, legal fees, and inspections.

Emergency fund: Owning a home comes with surprises — from repairs to property tax bills. Keep a cushion.

Step 4: Get Pre-Approved Before You Shop

This step is huge. A pre-approval:

Tells you exactly how much you can afford.

Locks in an interest rate for 90–120 days.

Gives you credibility with sellers.

It’s the difference between “browsing” and shopping with confidence.

Step 5: Explore Newcomer-Friendly Programs

Canada has incentives designed to make homeownership more accessible:

First Home Savings Account (FHSA): Tax-free savings dedicated to buying your first home.

Home Buyers’ Plan (HBP): Withdraw up to $60,000 from your RRSP for a down payment.

First-Time Home Buyers’ Tax Credit: Helps cover legal and closing costs.

Land Transfer Tax Rebates: Offered in several provinces and cities.

Some banks also run “New to Canada Mortgage Programs” — with flexible credit and down payment requirements.

Step 6: Budget Beyond the Mortgage

Your monthly mortgage payment is just the start. Plan for:

Property taxes

Home insurance

Utilities (heating, electricity, water, internet)

Maintenance (rule of thumb: 1–3% of home value annually)

Condo or HOA fees (if applicable)

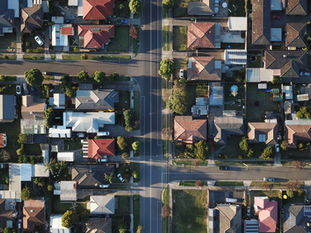

Step 7: Choose the Right Neighbourhood & Home

Location is everything. Think about:

Commute times and public transit

Schools, healthcare, and community services

Safety and future development plans

Home type (condo vs townhouse vs detached)

Remember: your home isn’t just where you live — it’s an investment in your future.

Step 8: Work with the Right Experts

You don’t need to figure this all out alone. Surround yourself with:

A mortgage broker (like Swivel!) to shop the market and find newcomer-friendly options.

A real estate agent who knows the local market and can negotiate on your behalf.

A lawyer to review contracts and protect your interests.

A home inspector to spot costly issues before you buy.

Step 9: Read Every Document Carefully

Never rush paperwork. Review:

Mortgage terms (rate, prepayment options, penalties).

Condo documents (if applicable).

Utility costs, property taxes, and reserve fund details.

Knowledge is power — and it can save you thousands.

Step 10: Be Patient but Ready

The Canadian market moves fast, but the right home will come. Be prepared to act quickly when you find it, but stay disciplined with your budget. Don’t let excitement push you into financial stress.

Final Thoughts

Buying your first home in Canada as a newcomer isn’t just about having a roof over your head — it’s about planting roots, building wealth, and securing your future.

At Swivel Mortgage Group, we’ve helped countless newcomers navigate the process with confidence. If you’re ready to start your journey, reach out to our team. We’ll guide you every step of the way — from pre-approval to move-in day.